Should I Sell My House Now?

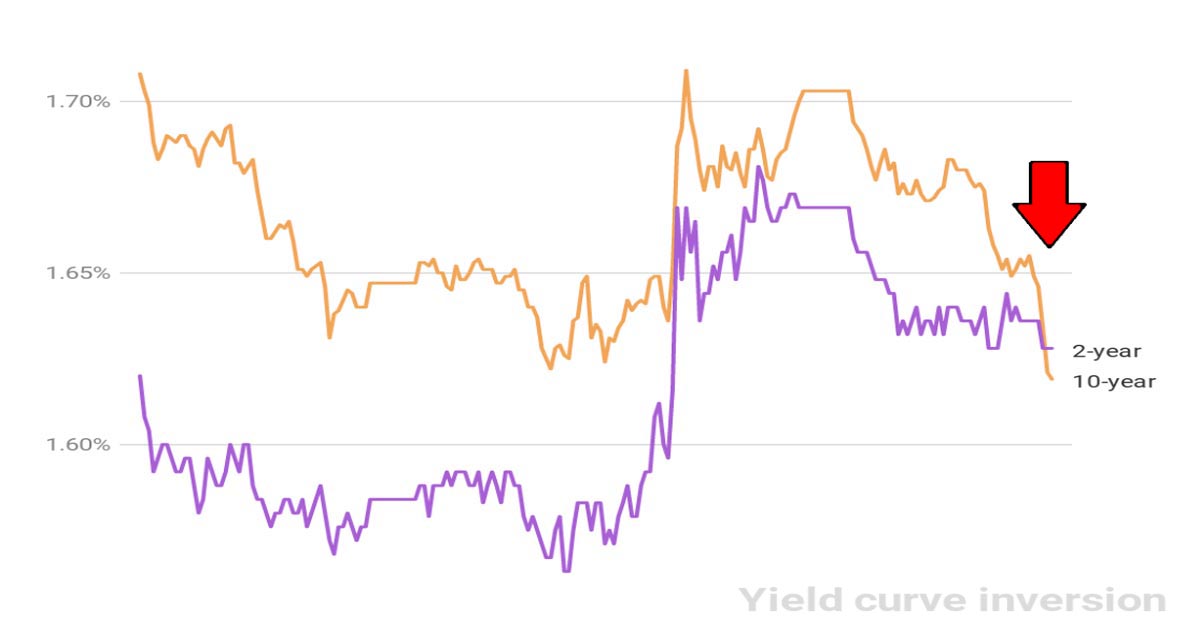

Just a few short weeks ago, we saw yield curve inversion in the market. If you don’t know what that is, don’t worry I didn’t either when I first read about it. To keep things simple, this just means that the short term bonds pay a higher return (yield) than the longer term bonds. In a healthy economy, bondholders typically demand to be paid more for longer term bonds vs shorter term bonds.

So why is this important?

“The inverted yield curve for US Treasury bonds is among the most consistent recession indicators”. All nine major recessions since 1950 have been preceded by an inverted yield curve. This basically means a recession is extremely likely.

And why is this important for homeowners who are debating “Should I sell my house now”?

During a recession there are many factors which affect the housing market. Home prices begin to fall as unemployment rises. As more homeowners are faced with financial difficulty, many are forced to sell their homes. Some homeowners find themselves in jeopardy of losing their homes to foreclosure. As the supply of homes increases, active homes (homes for sale) sit on the market longer. Banks and Lenders start tightening their guidelines and credit starts to dry up thus limiting the pool of buyers.

What does this mean for homeowners looking to sell their home?

While no one has a crystal ball, it’s important to take a close look at your current situation and what your plans on for the next few years. Homeowners interested in selling their home in the near future (the next year or so) should pay careful attention to these indicators to determine if selling now makes sense. It’s no secret that you should buy at the bottom of the market and sell at the top of the market. The challenge is timing it correctly, since chasing a downward market is not only stressful but will give you less of a return on your property.

I asked the following questions to two other very successful real estate investors in New Jersey to gauge their view on the market. Here’s what they had to say:

What is your view on the current real estate market and where it’s heading?

Carol Stinson, a seasoned investor in New Jersey, said

“I feel the current real estate market is still unstable. What I mean by that is that NJ is still in a foreclosure crisis. There were almost 48,000 new foreclosure filings in 2018. With thousands more properties going into foreclosure this year when all of the loan modifications from 2013 – 2014 reset. That said I think we are about to see an even larger influx of REOs by the end of the year. When all of these REOs hit the market end of 2019 beginning of 2010 it will create a shift in the current market prices resulting in another decline in property value. So to answer your question, The current real estate market is just a mirage making it seem like things are getting better. The market is inevitably about to crash again.”

Shomail Malik of Apex Capital Group also believes we are headed for a correction, however, he doesn’t think it will be as bad as our most recent crash on 2007/2008:

“There are two things to consider here. Firstly, real estate is cyclical. What goes up, eventually does come down, and perhaps not all the way down, but there is likely a correction expected soon. Currently there is a ton of liquidity on the market being deployed to investors to fix up properties, which is taking prices up across board in markets here in NJ. Secondly, we are seeing loosening of lending guidelines, which is what got us in trouble back in 2007/08. I think we’re going to see 2 things happening: 1) People getting into houses they really couldn’t afford, which they will default on later and 2) Rookie investors taking on projects that they’ll ultimately default on. For the first time, I’m seeing Hard-Money Lenders lend to first-time rehabbers, and some of those projects ending up on the MLS as half-completed rehabs. These are some tell-tale signs that a correction is just around the corner, perhaps 12-24 months from now. I don’t think it will be as acute as 2008, but I think it will be big and more gradual.”

Many sellers are wondering if they should sell or wait longer. In your professional opinion, do you think this is a good time for sellers to sell or to wait?

Carol believes you should sell only if you have to:

“I think, unless they absolutely have to sell, sellers should wait to sell until all of the smoke clears from this foreclosure mess. Housing prices will rebound quickly once all of these new loan mod reset foreclosures sell. Because once again the RE Investors will be there to clean up the mess. In 2020 Investors will be buying and fixing these properties and putting them back on the market increasing property values. That’s when sellers need to sell and get the most out of their equity.”

Shomail on the other hand, thinks it’s a perfect time to sell:

“If I were a seller in today’s market, I would wait until just after school starts for the market to pick back up again. That compounded with the fact that the Fed has stopped doing interest hikes and current 30-yr fixed rates for a primary residence right now are in the mid-3’s, makes it a conducive selling environment. I believe a correction in home prices is around the corner, so if I’m a seller looking for top dollar for my home, I would go on the market today.”

Here are some other important factors to consider while determining if selling your house now makes sense. The GDP is at 2.0% at the time of this writing, the GDP needs to be over 3 to 3.5% as per Grant Cardone. It fell from 3.1 percent in the previous quarter of 2019. Again, no one has a crystal ball as to what the future holds, however, these indicators have a proven track record. If you are thinking about selling your home sometime within the next 2-4 years ( I say this because real estate cycles are typically 5-7 years), then you should give this deep thought. I hope this article helps in your decision of whether you should “Sell my house now” or if you should Sell my house later.

If you have a house in Morris County, New Jersey and you want to sell now, please fill out the “Should I Sell My House Now” form on our Sell Now page and we’ll provide you with a no obligation cash offer in 24 Hours or less.